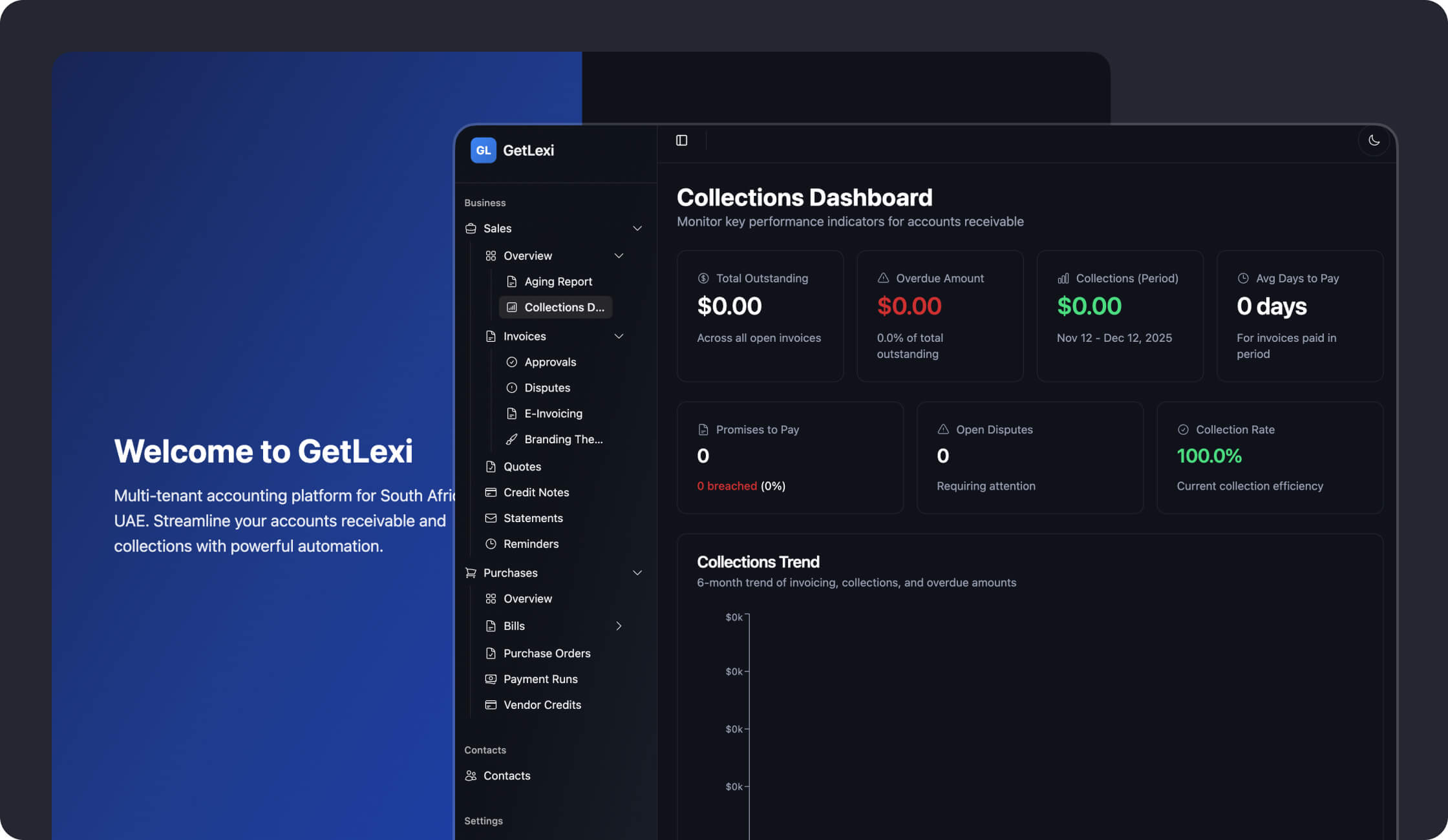

GetLexi

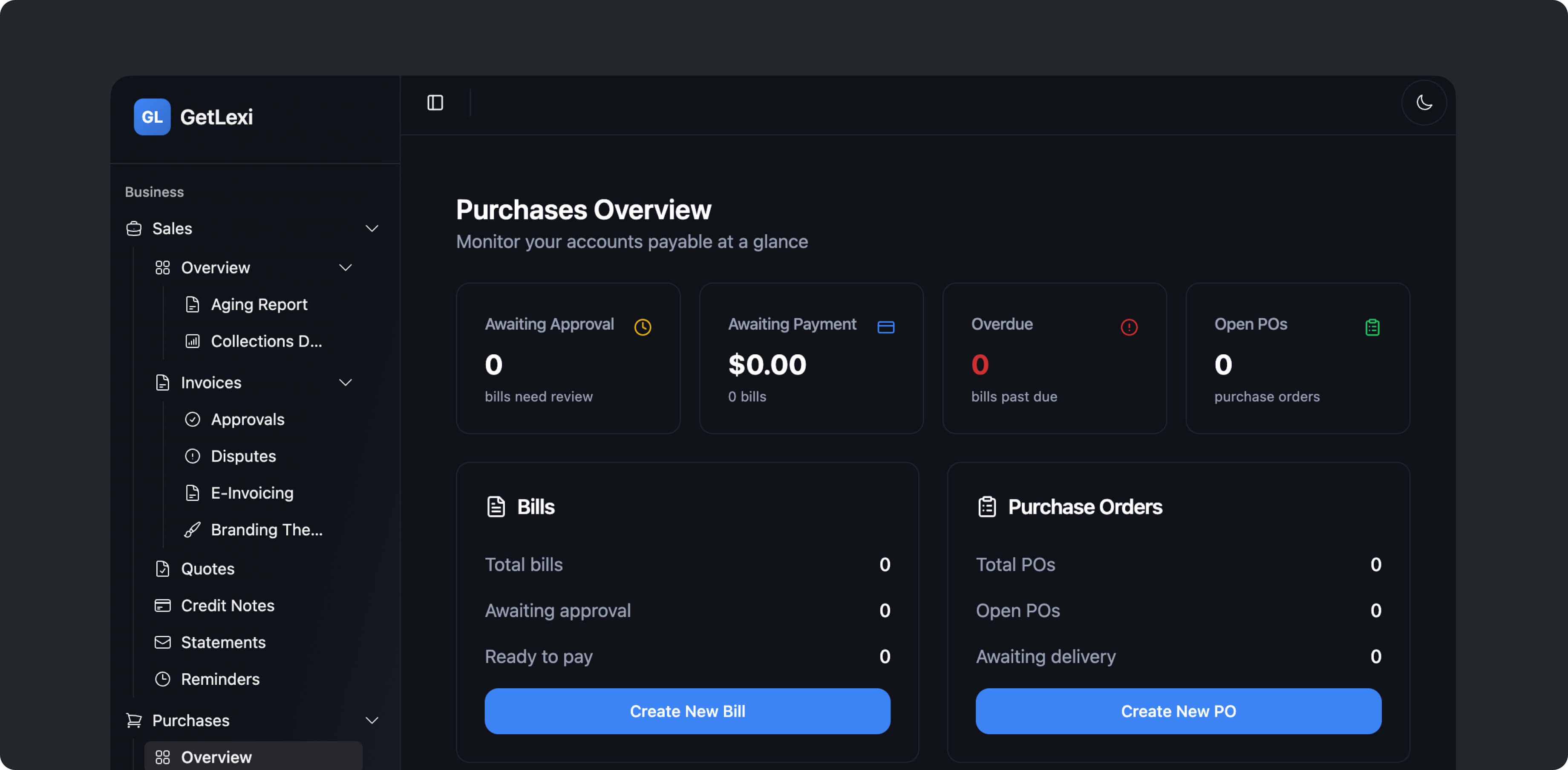

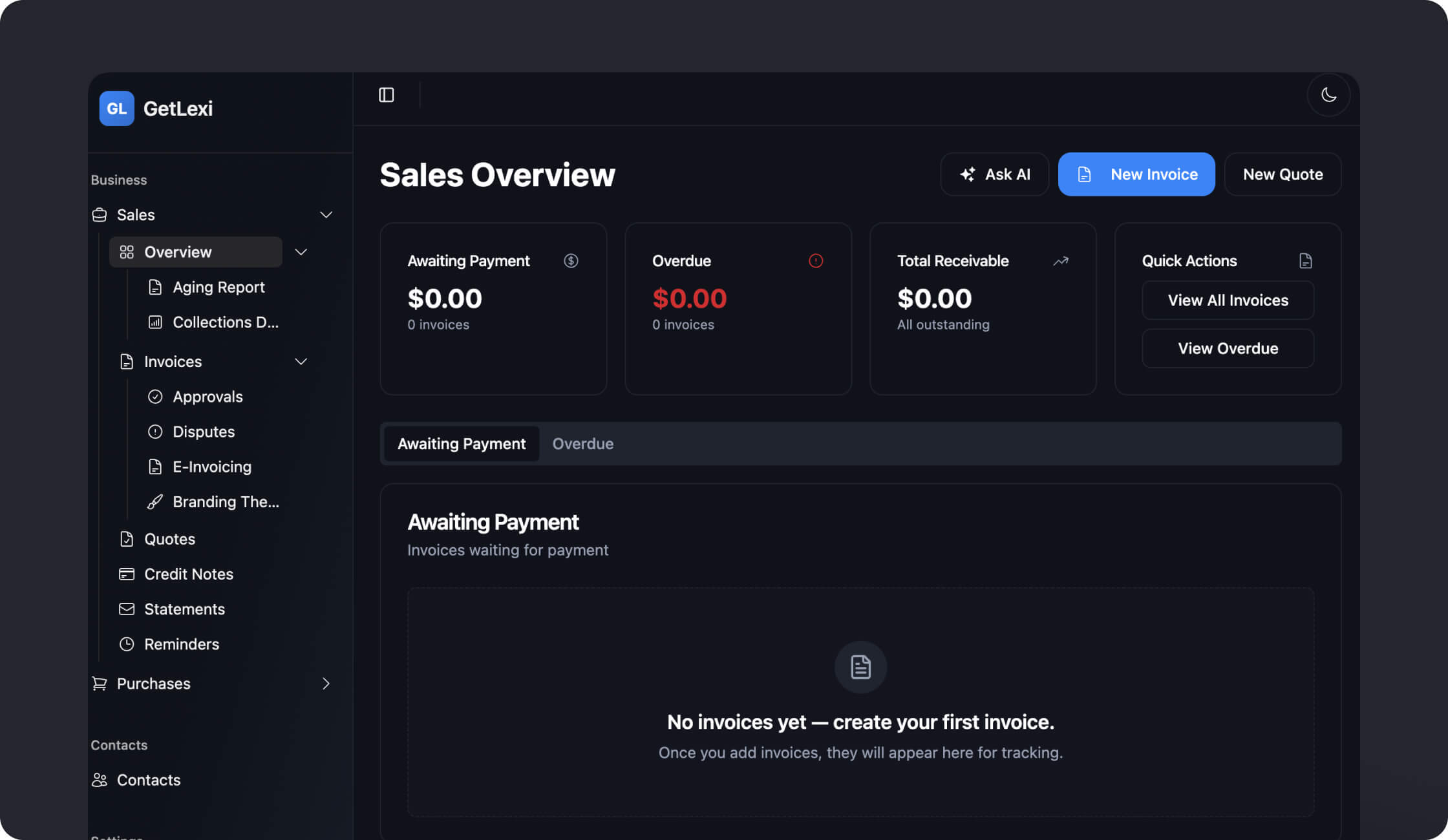

We partnered with the team to build a fully automated Accounts Receivable platform that streamlines quotes, invoicing, payments, reconciliation, credit control, and collections into one governed, auditable workflow.

What we worked on

Accounts Receivable Automation Payments & Collections Platform Financial Reporting & Compliance

Year completed

2025

Background

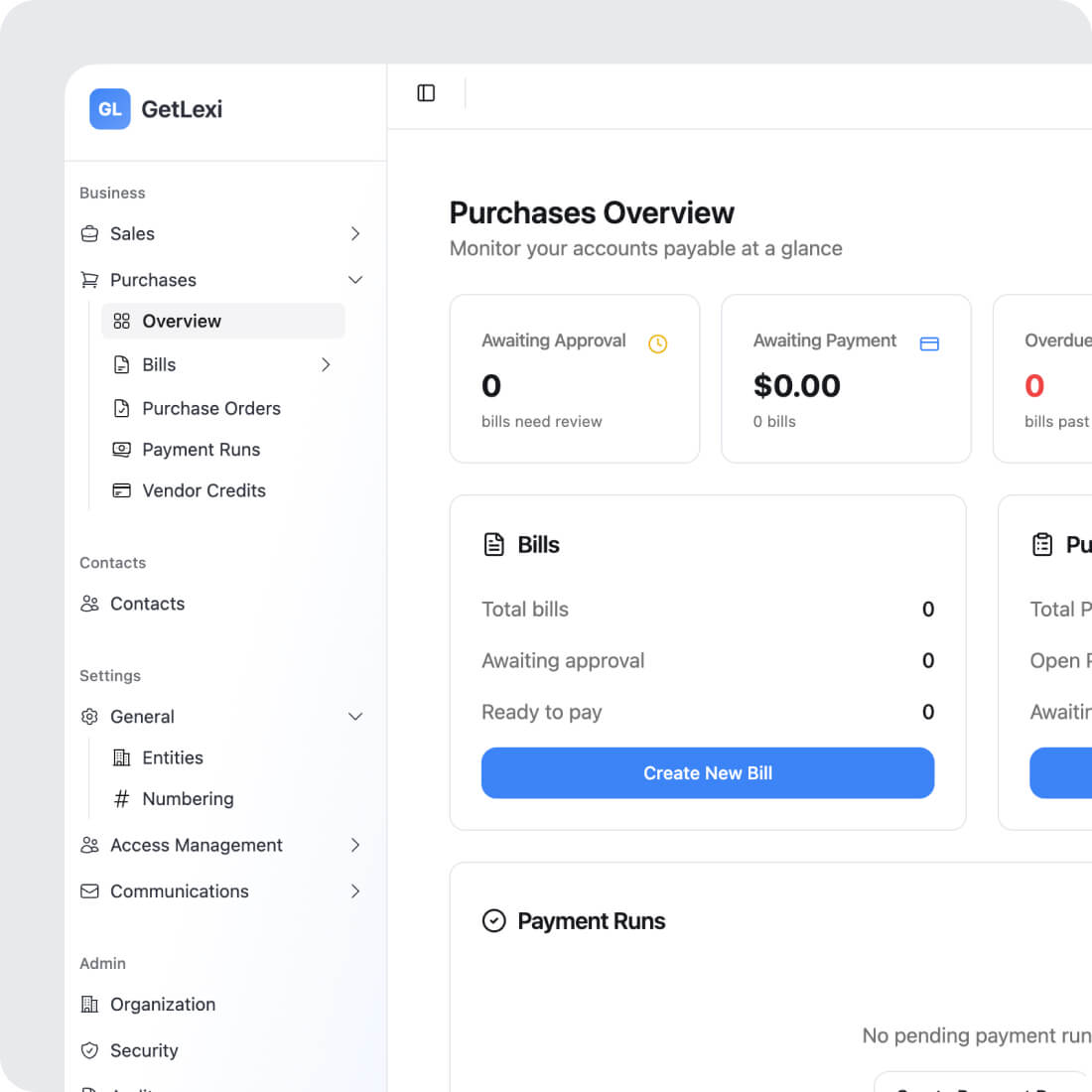

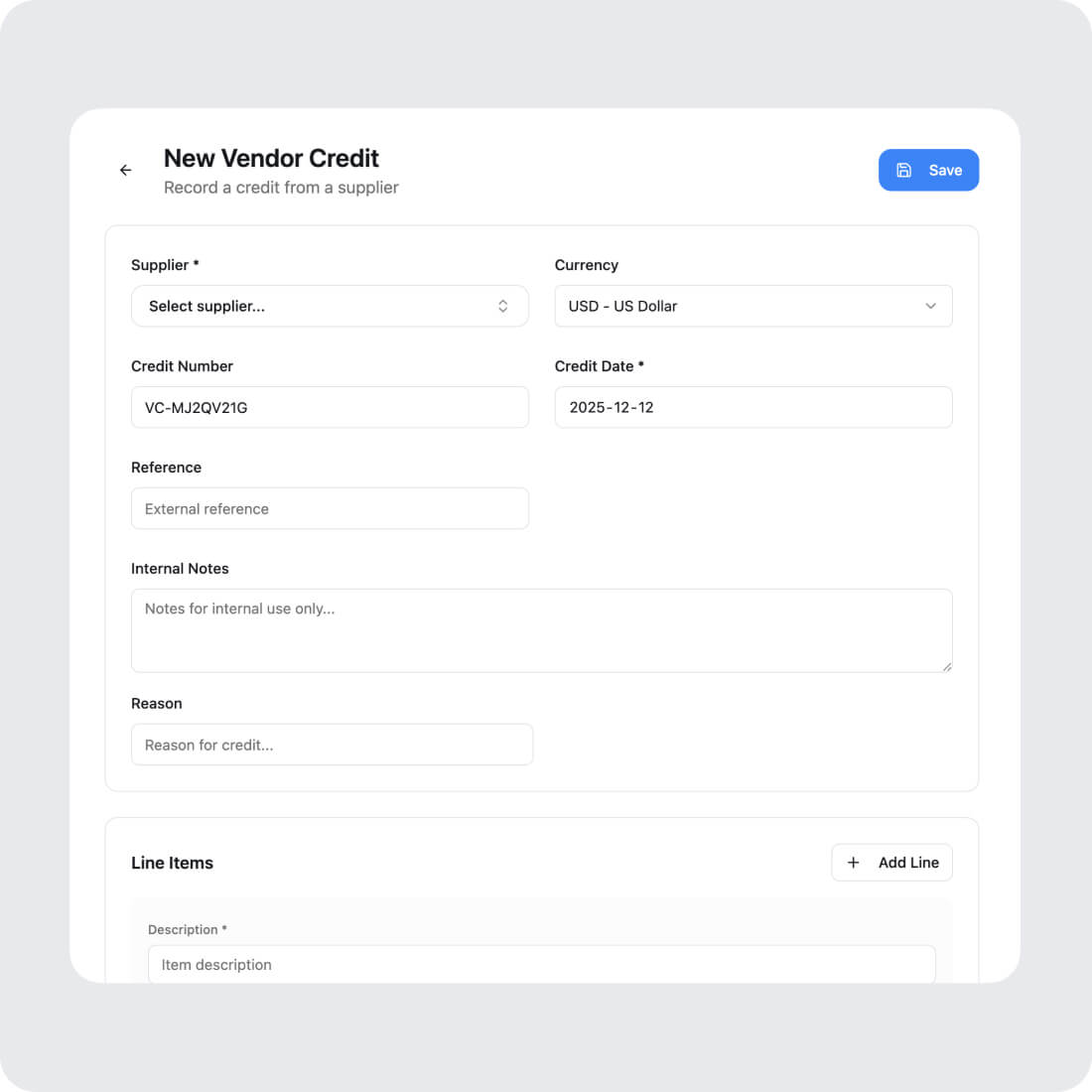

The product initiative set out to modernize the end-to-end Accounts Receivable lifecycle by replacing fragmented tools and manual processes with a unified financial operations system. The goal was to support everything from quotes and invoices to payments, credit notes, refunds, dunning, and customer self-service, all backed by a governed semantic layer for analytics. The platform needed to reduce DSO, improve on-time payments, strengthen credit risk controls, and ensure financial accuracy tied directly to the general ledger. A robust, permissioned, and fully auditable architecture was essential to support enterprise finance teams.

Challenges

Designing an AR engine of this scale required consolidating numerous workflows. Quoting, invoicing, allocations, adjustments, refunds, disputes, dunning schedules, and e-invoicing, into interfaces that remained predictable and intuitive for finance users. The data model had to support invoices, credit notes, payments, prepayments, allocations, tracking dimensions, disputes, and FX handling, all with strict auditability. The system also needed granular approvals, credit-limit rules, automated reminders, multi-currency calculations, customer portal actions, and deep integrations across banking, tax, reporting, and payment gateways. Coordinating these layers while maintaining accuracy, compliance, and usability across high-stakes financial workflows was one of the core challenges.

Outcome

The resulting platform provides a comprehensive AR solution that shortens the quote-to-cash cycle, increases on-time payments through automated reminders and dunning, and reduces financial risk with built-in credit controls. Users can manage quotes, invoices, payments, credit notes, refunds, disputes, and collections from a single governed system, while customers benefit from a self-service portal for paying and viewing statements. All actions are auditable, permissioned, and tied to a semantic reporting layer that powers KPIs such as DSO, overdue percentages, promise-to-pay conversion, and bad-debt ratios. Finance teams now have a scalable, compliant, and automated foundation for accurate AR operations.